Why Electricity is the Most Volatile Commodity

Electricity is the most volatile commodity that there is. The next most volatile commodity, crude oil, isn’t a remotely close second.

Here’s a chart of the price of a barrel of crude oil from 1970 to 2015:

During the Oil Embargo, the price rose 250%. In 2008, the price fell 70%1. The standard deviation of this price series is high. Clearly oil is a volatile commodity.

But oil’s volatility is nothing compared with electricity. The spot price of electricity in Texas can jump from $0/MW to $5,000/MWh in 5 minutes, then back to $0/MWh in another 5 minutes. Nothing else has price dynamics like electricity.

Electricity is so volatile that its price can’t be described with the same metrics and visualizations as other commodities. The last 50 years of oil price movements would hardly be visible when graphed against a single volatile day of electricity price movements. A graph of the last year of power prices would be too spiky to be interpretable. Whereas you might say “oil rose 2% yesterday”, the price of power one day has little to do with the day before. And whereas you might describe oil as having an average price over a day or a month, the price of power is often described as an average over a period of hours2.

Electricity is Not a Thing

Electricity is a fundamentally different commodity. It’s different because it has certain unique physical attributes that impact how it has to be produced, distributed, and used.

Electricity isn’t a tangible thing with a physical substance. It’s a phenomenon. Power guys sometimes say “we sell electrons”, but that’s not quite true. Electricity is the flow of electrons through a conductor. The conductors already have electrons. The power plants put those electrons into motion by, for example, in the case of a spinning turbine, converting mechanical energy into electrical energy.

The motion of the electrons has to occur at a specific frequency. If electricity is being put on the grid at a faster rate than it is being drawn off, then the frequency rises, and vice versa3. The equipment that produces and uses electricity will be damaged if the frequency exceeds certain bounds, so it’s necessary for power supply and demand to be tightly balanced across the entire system at every moment.

While the flow of oil in a pipeline can be directed by cutoff valves, the flow of electricity can’t be controlled. Electricity moves instantaneously across the network, following the pathways offering the least resistance.

All other commodities are physically tangible things that can be - really, have to be - stored before they’re used. Oil can be stored in tanks and cans, but electricity can’t be stored at all. The best you can do is to convert electrical energy into another form, then back again, with minimal losses depending on the method.

And all other commodities can be transported by different modalities: planes, trains, trucks, tankers, etc. Not electricity. Electricity is inseparable from the power grid. The grid is one integrated system, from the power plant to your microwave. And it has to be managed as one system.

These physical features require electricity markets to be structured extremely differently from other commodities, with significant economic implications. Power grids experience scarcity conditions far more frequently than markets for other commodities. And they experience scarcity far more acutely than other markets do.

Centralized Clearing

Power’s physical differences require it to be traded in a significantly different market structure.

Other commodities are traded bilaterally - either on an exchange or ‘over the counter’ - between two parties. You can imagine the market as a network of traders and relationships between them, and related traders transact as the need arises. There’s no single price, just various exchanges and indices.

Oil trades as freely and openly as the oceans it’s transported on. In contrast, the trading of electricity is managed and controlled, reflecting the constraints of the power grid.

Because the power grid has to be managed as one system, to maintain balance and manage transmission congestion, the market has to be cleared in an auction by a centralized entity. All loads submit bids and all generators submit offers, then the system operator clears the entire market at once, accounting for transmission constraints.

It isn’t the primary driver of volatility, but there is some reason to think that auctions tend to see more volatility than bilateral trading. In bilateral trading, the price moves incrementally as individual trades occur. This decentralized price discovery responds more gradually to new information. The web of counterparty relationships buffers against volatility. In auctions, the market recalibrates all at once.

And the market has to clear nearly continuously - typically every 5 minutes. That’s because electricity travels instantaneously and physical supply and demand need to be balanced at every moment. In comparison, oil markets move very slowly. Tanker ships travel at 15-20 mph, and the oil in pipelines crawls along at 3-5 mph. There are long lags between physical production and physical consumption in oil. In power, because delivery is instant and because the grid needs to be balanced, supply and demand are physically coupled in real-time.

Storage

Electricity can’t be stored directly. It can be converted into another form of energy and then converted back. The losses involved in that process make storage of power highly inefficient compared with storage of other commodities.

In a sense, a commodity’s entire distribution system functions as storage. In between production and consumption, crude oil is held in storage tanks, in pipelines, on tankers, and at refineries. The same is true for refined petroleum products.

At any given time, a significant portion of world oil supplies are in transit. Distribution acts as a buffer between supply shocks and price movements for oil, but not for power. While the Trans-Alaska Pipeline holds 9 million barrels of oil, power transmission lines don’t ‘hold’ electricity at all. They conduct electricity, and they deliver it instantly.

Storage does exist in power. Pumped-storage hydroelectric power uses power to pump water into an elevated basin so that the water can later be released downhill to spin a turbine. Energy can also be stored in utility-scale batteries. But this storage has extremely limited capacity compared with any other commodity.

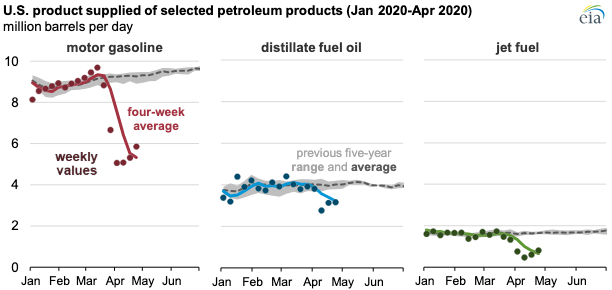

Glancing at the EIA’s petroleum status report on the week I’m writing this, it looks like the U.S. has 1.623 billion barrels of petroleum products in storage4 and we consumed5 20 million barrels per day over the last four weeks. That’s ~81 days of product in storage6.

In contrast, electricity is distributed instantaneously, so there’s no storage capacity in the distribution system. And while in ERCOT there are 6.3 GW of battery storage capacity7 and 0.56 GW of hydroelectric capacity, this is tiny compared to ERCOT’s load record of 85,931 MW set August 20, 20248. While oil storage capacity can serve weeks of demand, power storage capacity can’t serve the system’s demand for one second.

Storage capacity absorbs shocks to both supply and demand. If retail demand for oil falls, some traders will buy oil at those lower prices to build up their storage stocks. This demand in turn props up prices. And if retail demand rises, any shortfalls in production can be made up for by drawing down inventories.

Storage capacity cushions price reactions to changes in production and consumption by creating reserves of supply and demand. The more storage capacity, the more slowly prices will change.

And storage isn’t the only shock absorber that the oil market has. Producers can throttle up or down pumping of already-dug wells. And since so much supply is in-transit, it takes a long time for physical changes in supply and demand to propagate through the system.

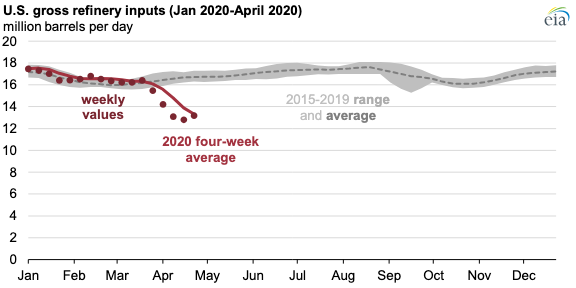

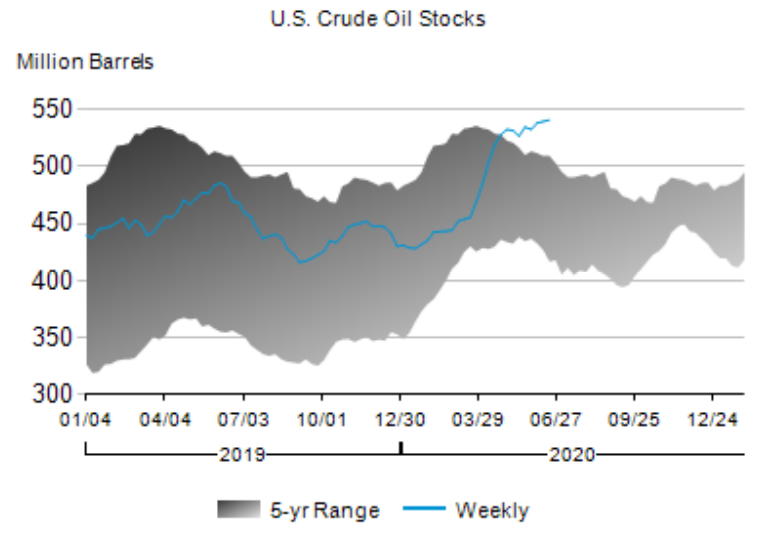

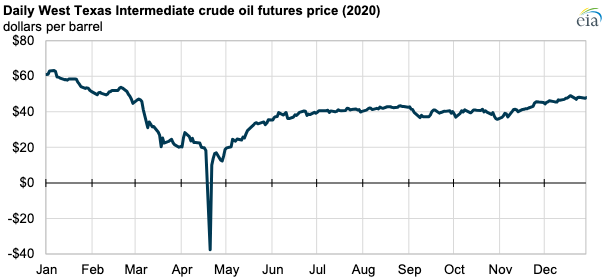

But in 2020, we saw what can happen when these shock absorbers are exhausted. In the first two months of the public health emergency, fuel demand dropped 50% and refiners and producers both throttled back. Even still, storage inventories quickly reached an all-time high, and with unprecedentedly little storage capacity remaining, crude oil prices briefly spiked into negative territory.

That was a rare moment in the history of oil, but similar dynamics play out in power regularly. The oil system has never had less spare storage capacity than in April 2020, but the power system never has much storage capacity at all.

When demand for power is low, the small capacity of battery farms is quickly filled up, and then the excess power has nowhere to go. Power plants throttle back or turn off. Oftentimes the entire system’s load can be served primarily by baseload power plants like nuclear, who are willing to stay online no matter the price because it’s cheaper than shutting down and then starting up later, and by ultra-low marginal cost producers like solar and wind, so prices fall. If the grid had significant storage capacity like exists for other commodities, prices would be buoyed by demand to build inventories so that power could be sold for higher prices later. But storage capacity is low, so prices frequently fall to near $0/MW9.

When demand for power is high, the small capacity of battery farms is quickly discharged onto the grid, and then the entire system’s load has to be served by producers in real time. Power plants turn on and throttle to maximum capacity. Sometimes there is so little power generation capacity left on the sidelines that in order to meet demand on the system, the grid operator is forced to dispatch nearly every power plant on the grid. In economic terms, the market ceases to be competitive. Typically, when there is excess capacity on the grid, power plants bid close to their marginal cost so that they have the highest likelihood of being dispatched and earning revenue. But when there is no excess capacity left on the sidelines that could underbid them, they know that they can name any price and the system operator will be forced to accept it to keep from having to shed load. To address these situations, all grids have a cap on the maximum price at which the market can clear.

Because there is such little storage capacity on the grid, the market can swing more easily from one extreme to another. This is how power prices can swing so quickly from $0/MW to $5,000/MW and back.

Inelastic Demand

The lack of storage on the grid wouldn’t be so bad if it weren’t for the fact that power users don’t change their demand in response to prices.

Retail customers usually pay for power according to a fixed rate that they lock in for 1-12 months. So while customers are exposed to long-term trends in power prices when they renew, they’re completely indifferent to changes in wholesale prices throughout the day.

There’s much more volatility in grid conditions within the day than from month to month. In a given month, not much new generation capacity comes online, and not many new loads are connected to the grid. The supply and demand stack changes much more within the day, as renewable generation comes on and off, generators have outages, and power users go through the rhythms of their day.

That creates a challenge. Prices tell customers how much of a good they should use. When gas prices rise, people cut back on unnecessary trips. In a perfectly functioning power market, we would expect power customers to do the same. When the grid is short on supply, people would restrict their power usage to more essential activities (like air conditioning), holding off on less essential activities until there is more ample supply. But customers have no incentive to do that because they pay the same rate no matter the condition of the grid.

There are practical reasons why the retailing of electricity works this way. In the earlier days of power, the home meters could only record the total energy used over a period of time. They couldn’t record the power used at different moments in time. So monthly billing at a flat rate made sense.

Today, many homes have ‘smart meters’ that can record power use as a time series. Many retail plans now have a daytime and a nighttime price, reflecting that on average wholesale prices are lower at night. This should somewhat encourage customers to shift their discretionary power use - charging electric vehicles, running the dishwasher, etc. - to nighttime.

But it’s still generally considered impractical to expose customers to real-time prices. If the customer is away from home, or misses the notification about a price spike, they could have a large bill that they’re unable to pay. And in a sense10 it’s the responsibility of the retailer to have the capacity available to serve their customers’ peak demand. So if they incur a high cost of service on peak load days, it seems right that they should eat that cost and not pass it onto customers.

The problem is that the indifference of customers to real-time prices increases volatility. If the supply of oil becomes constrained, prices will rise, consumers will use less, and then prices will fall. They won’t fall all the way back to where they were before, but the response of consumers to prices does limit how much prices can rise or fall. Only a very small percent of power demand is responsive to price in that way.

An even larger problem is that the unresponsiveness of customers to price has led to shortages. Imagine one of the rare days when ERCOT has issued an Energy Emergency Alert because there’s a risk that available capacity won’t be enough to meet demand. In a properly functioning market, you would expect that people would restrict their use of power to only the most essential needs - lights, air conditioning, electronics, etc. But in reality, customers have no financial incentive to use power any differently that day. The grid could be tipped into rolling blackouts by people running their HVAC with a window open.

Intermittent Renewables

There’s one final contributor to volatility to mention. It’s not a direct consequence of the unique physical features of electricity. It’s more of an interesting coincidence. But it’s the biggest driver of increasing volatility in power markets today.

On some grids, a large portion of capacity comes from solar and wind power plants. There’s a fascinating trade-off to these technologies. On one hand, their ‘fuel’ is free, so they produce power very cheaply, significantly lowering the market clearing price for power when they’re generating. On the other hand, their ‘fuel’ comes from the environment, which can’t be controlled and may change very quickly.

This contributes to volatility because it means that the supply curve can shift significantly. In EROCT, it’s not uncommon for wind to drop from being 15% of supply to 5% of supply in 2 hours.

Consider how such a supply shock would impact the oil market compared with power. Oil has many built-in shock absorbers to buffer the impact of the supply shock that, for physical reasons, don’t exist in power.

In oil, the information about the supply shock travels through a decentralized web of counterparties who iteratively bid up the price. In power, the information is immediately visible to all parties and the real-time auction clears a new price 5 minutes later. In oil, there are significant distribution lags between a shock to production and impacts on physical delivery to customers. In power, the supply shock impacts physical delivery instantly. In oil, there are large inventories of stored product to draw from. In power, storage inventory is minimal. In oil, consumers use less as prices rise, averting shortage. In power, consumers are indifferent to rising prices, threatening shortages that will cause rolling blackouts. Have fun out there!

-

Remember that a fall of 50% wipes out as much as a gain of 100%. ↩

-

These periods are ‘on-peak’, weekdays from 6am to 10pm, and ‘off-peak’, weekends and holidays or weekdays from 10pm to 6am. There is generally a different regime of power demand during these different times, because of the rhythms of daily life, and thus a different price regime. ↩

-

In other words, the frequency depends on the balance of the rate at which energy is being converted into electrical energy versus the rate at which electrical energy is being converted into other, more directly useful, forms of electricity such as heating a kettle. ↩

-

I think that this includes both oil in tank farms and in tankers, pipelines, refineries, etc. ↩

-

The actual word used is ‘supplied’, meaning that the gasoline was delivered to the retailer, the jet fuel delivered to the airport, etc. Also, note that I’m lumping barrels of crude and all refined products together, which is wrong but acceptable for napkin math. ↩

-

I don’t know much about oil so I assume I’m making some basic mistake in this napkin math. But I’m confident that my general point is correct. ↩

-

Source is the EIA Generator Inventory. Note that this refers to capacity to deliver instantaneous power, not energy storage capacity. There’s less clear data on energy storage capacity, but I’d roughly estimate it at 10 GWh at time of writing. ↩

-

https://www.gridstatus.io/records/ercot?record=Maximum%20Load ↩

-

In fact, prices are frequently negative. That’s largely because the Inflation Reduction Act gives a tax credit of $30/MW to renewable power plants, so those producers are willing to supply power at -$29/MW. This encourages building of renewable power plants, and it reduces power prices and power bills for retail and industrial power users. Another cause of negative prices is that, in rare cases, a baseload power plant might be willing to sell power at negative prices because they judge it cheaper than the cost of shutting down and starting up again later. ↩

-

The literalness of this responsibility varies by grid and will be a subject of a future article. ↩